This is a bit lengthy, but I think you’ll find it juicy and delicious. Pour another cup of coffee.

The Back Story

In recent months, Philadelphia has been rocked by a series of stunning nonprofit organization failures: The University of the Arts (UArts), Benefits Data Trust, and Resources for Human Development top the list. Among them all UArts stands out, perhaps because of the sheer volume of media coverage, too numerous to link here (just Google it), and perhaps because the plight of those affected–the students and faculty–offers such a visceral connection to what happens when management and governance are responsible for institution-ending failure.

Unlike the other institutions named above, I’ve had a direct and indirect relationship with UArts for more than a decade. Most notably, as a consultant to the Philadelphia Art Alliance from 2015-17, I facilitated its merger into UArts, which yielded a series of posts:

A Battle between Ownership and Stewardship (Act 1) - Golden Age Beginnings

A Battle between Ownership and Stewardship (Act 2) - Evolution to Descent

A Battle between Ownership and Stewardship (Act 3) - Crisis of Institution

A Battle between Ownership and Stewardship (Act 4) - Resolution and Conversion

While my client was the Art Alliance, this process afforded me a disconcerting view into the management culture of UArts, which seemed trained on building out its real estate empire according to a rather free-wheeling logic. The Art Alliance was heading to a point of financial insolvency and was running out of options and time. Its chief bargaining asset was its home for over 100 years, the Wetherill mansion on Rittenhouse Square, valued at ca. $15 million. When UArts expressed interest at the eleventh hour, it was the only option on the table.

UArts brought their attorneys to the transaction, whose friendly rapport with Pennsylvania’s Attorney General assured us that the argument for the merger was sound. On the surface, there was some logic: small legacy arts education organization merges its assets with large arts education organization. Despite this broad mission parity, I still had questions about the rationale for UArts, in particular considering its long-term reputation for being cash and endowment poor. In one meeting I pressed then-president David Yager about the rationale for his institution. His response was that UArts was looking for more exhibition space for its museum studies program, space for continuing education classes, and a storefront presence on tony Rittenhouse Square from which he could court Philly’s nouveau bourgeosie. Setting aside the considerable balance sheet value of the real estate, which transferred for a dollar, UArts was facing hard costs of up to $5 million in deferred maintenance and estimated annual operating nut north of $500,000 for the building. Considering there were only a few thousand square feet of institutionally usable space to gain, I thought, “That’s a pretty dear cost for a few extra classrooms and an even more expensive advertising billboard for the Rittenhouse Richies.” But who was I to say? For the Art Alliance, it was the worst solution except for all the others.

It’s Business Basics Baby

On May 31, 2024 UArts announced that it would be closing in seven days. There were no warnings, no murmurings. In fact, no-one outside of the board (and even a few board members didn’t know!) and the president’s office knew the announcement was coming. Everyone from the provostial level down found out with the rest of us when the Philadelphia Inquirer broke the story.

As expected, conspiracy theories began to swirl through social media–colluding developers and board members trying to grab the university’s real estate, corrupt senior management fighting to retain their jobs, and the like. When confronting cataclysmic events such as this, we seek and are comforted by simple answers, even if they entail nefarious, mustache-twisting board members. But nonprofits are complex systems embedded in even more complex systems. Their failure is rarely the result of a grand diabolical plan or single point of corruption, and more commonly the confluence of multiple circumstances and long-term weaknesses that together reach a failing point. This answer provides less comfort, as it reveals the fragility and somewhat stochastic nature of systems, much of which may lie outside our control or comprehension. That said, there is still a finger to point at board and management at UArts. They are the system engineers and should have at least been able to sound collision earlier than they did.

Much of the investigative journalism after the announcement and testimony to Philadelphia City Council focused on allegations against former UArts president Yager and his short-lived successor Kerry Walk. One claim is that Yager played a game of three-card monte with capital fundraising, double-counting older pledges to make it look like he was a more successful fundraiser than he was. There was also criticism that over-investment in real estate and not enough effort on fundraising drained the university’s coffers. There may be some truth to both claims; my experience with the Art Alliance project might support the latter.

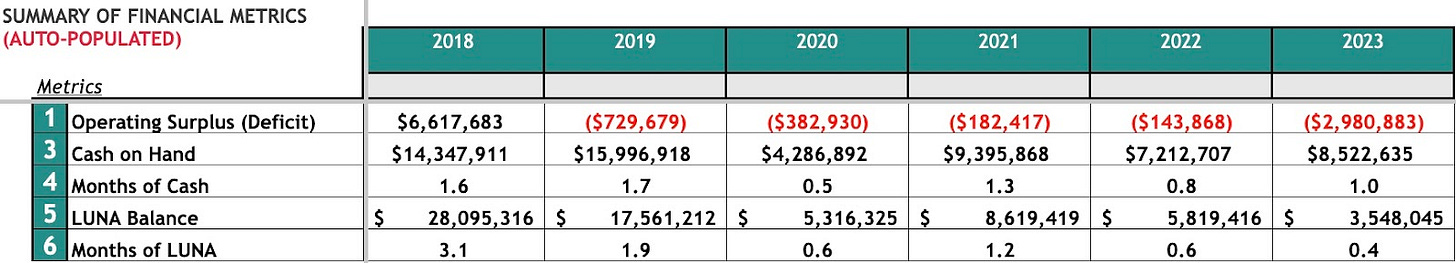

My colleague and nonprofit finance expert Asta Petkeviciute and I were asked to do a little financial analysis for one of the local media stories on UArts. Asta did the analytic work, but our commentary didn’t make it into the piece. We found that setting aside the above claims, UArts had been suffering from a common weakness among nonprofits: undercapitalization and limited cash reserves. For several years, UArts had experienced a marked decline in Liquid Unrestricted Net Assets (LUNA), which are the equivalent of “profit” in the nonprofit sense–remaindered unrestricted cash assets at the end of the year. This is one of the main indicators of nonprofit health. Instead of being distributed to owners or shareholders, in the nonprofit sector LUNA are generally allocated first to “working capital” or the cash you have on hand at any given time to meet expenses. (If you accumulate a lot of LUNA, it can be designated by the board to be invested as an endowment or set aside for various other mission-related capital purposes.) Generally, a healthy nonprofit should have at least 90 days of LUNA. Larger organizations, with more seasonal income ebb and flow, such as universities, may need more like 6 months of LUNA to operate safely.

We plugged into a financial health assessment tool year-end figures from UArts’s IRS Form 990 returns (the nonprofit federal tax returns) for 2018 to 2023. We also looked at their independently prepared financial statements and noted some reporting differences between the 990s and audited statements, as well as a number of things that left us wanting clarification. Those caveats aside, the analysis showed a major shift in net assets between 2018 and 2019 from 3.1 months of cash on hand, to 1.9 months. (The big jump in deficit is owing to the recognition of net Art Alliance assets in 2018.) This then continued as a trend to decline, with another major negative bump between 2022 and 2023. In all, LUNA decreased over these years from 3.1 months to just 0.4 months (ca. 15 days!) of cash on hand in 2023–a far cry from the 90-days plus needed to operate at minimum health.

In the end, a long-term structural operating deficit killed UArts, not a capital fundraising shell game or evil provost. Capital fundraising and facilities may have contributed to these trends, but the overall issue of diminishing liquidity is clear and the main issue at hand. This financial picture warrants a five-alarm response, but structural deficits and thin operating reserves are regrettably not unusual in the nonprofit sector. Of the 1.8 million nonprofits registered, most (ca. 50% at last count) operate with less than 30 days of cash on hand. We don’t know what, if anything, was being done about this at the board and management levels over the past few years. Potential management responses to this kind of a trend would include cost cutting, liquidation of illiquid assets like real property (which UArts did in this period, but it wasn’t enough), or efforts to increase earned income (mainly tuition in this case) and fundraising–easier said than done given Philadelphia’s poverty of philanthropy. However, once you get to the above precipice, it’s almost impossible to incrementally get back to safety; you would need a financial intervention of extreme proportions.

Shrinking Market & Commercialization

The UArts case needs to be understood in the broader context of the ongoing failure of the higher education business model that developed over the later 20th century and related market-based down-sizing of an overbuilt ecosystem.

Much of America’s higher education institutions are a product of early 20th century population booms and post-war educational incentives, such as the G.I. Bill or Servicemen's Readjustment Act of 1944, which supported returning veterans to go to college. Colleges and universities multiplied to meet this need after World War II. But by the later 20th and early 21st centuries, downward changes in population, the overall economy, and most critically, the costs of higher education have dampened enrollment significantly, resulting in a market right sizing trend that in recent years has seen small to mid-size colleges close at a rate of one per week.

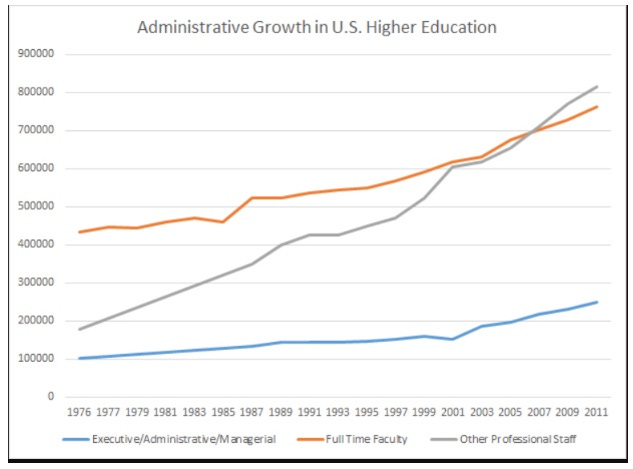

A big part of the downturn in American higher education are soaring tuition costs. How did we get to this point? There are many theories, but perhaps the most compelling answer comes from the work of anthropologist and economist David Graeber, largely discussed in his book Bullshit Jobs. Graeber basically contends that at a certain point around the 1970s larger nonprofits, notable eds and meds, began to “professionalize” and build management structures that mimicked corporate models, starting with introducing and expanding the C-suite. Prior to that point in the U.S., we generally didn’t see titles like “President & CEO” in nonprofit management, nor CFO, COO, CTO, and the rest of the senior suite. Graeber argues that once we started down that path, those execs needed people to report to them, and thus the V-suite was begotten, and those managers needed their own cadres of factota, and so on.

Before we knew it, we had a bloat of “bullshit” management jobs, and those managers all needed things to do, so nonprofit bureaucracy exploded. This explains why the administrative burden on faculty and doctors–the people actually doing the mission–related work of these institutions only got worse over the last half century, not better, contrary to the greater-efficiency sales pitch used to justify the additional cost. I have my own theories about who lit this administrative fire. I blame the advent and precipitous growth of the management consulting industry starting in the 1960s, which remains a tremendous private drain on the nonprofit sector as they work to impose private asset management principles on a public trust sector where those ideas are largely inappropriate.

The result was a four-fold increase in administrative staff over that of faculty from 1976 to 2011, as shown in the above analysis. This growth in “administrative maturity” created a market race to cover these costs. And of course it costs money to make money, so ultimately this has become a vicious economic cycle, foretold by former Harvard president Derek Bok in his landmark 2009 book, Universities in the Marketplace: The Commercialization of Higher Education. In the face of growing costs and mounting needs to demonstrate value, higher education shifted to a service-and-amenity model that has resulted in colleges presenting themselves more like competing country clubs than educational institutions, not to mention converting families and students into entitled customers, not beneficiaries of learning.

But the fancy stadiums and dorms are not sufficient. As Bok describes, universities shifted their business model to IP transfer (monetizing the intellectual toil of faculty, largely without added gains for the researchers), exploitation of sports-related giving and franchising, real estate speculation, and becoming the unindicted co-conspirator in the greatest debt boondoggle of our time: the predatory student debt industry. Today, student loan debt is second only to mortgage debt in the U.S. with most held by shady lenders like MOHELA. These are the economic forces propping up higher education, not the value of education itself, which is eroding with each passing generation and a changing job market.

Concerning UArts, the role of real estate speculation looms and we can read the above shift in the succession of presidents from a run of leaders focused on education to Yager, who spent a lot of time on real estate. Among UArts’ Philly peers, Drexel and University of Pennsylvania, the university-as-real-estate-developer model is even more legible. John Fry, a real estate developer at heart, led Penn’s consolidation of a huge swath of West Philadelphia (University City) under president Judith Rodin in the 1990s. He went on to run the same playbook as president of Drexel, and will do so again as incoming president of Temple University. While he is lauded as an “innovator”, I see his presence in higher education more as evidence of a blighted and dying institutional model that has lost its mission way.

A Few Hypotheses

Despite the reality that higher education is in the midst of a “natural” market correction, compounded by self-inflicted administrative obesity, the question remains as to why the end came so abruptly, without clear explanation, and with a flourish of managerial incompetence that would make the Keystone Cops blush.

Since it wasn’t the wake of a natural disaster, the answer is massive failure of governance and management, plain and simple. In the nonprofit sector that’s how the chain of responsibility goes: from God, to the state’s Attorney General, to the Board, to Management. Concerning UArts, God and the AG have an alibi (they weren’t in town at the time), so it’s all on the board and management. As discussed above, the situation likely has some complexity and there is probably not a single smoking gun, which doesn’t remotely excuse the manner in which the end came. From an outside observer, I wonder if one or more of the below syndromes I observe in nonprofit dynamics was at play. Though these are all unsettling negative dynamics, none entails nefarious intent.

Bystander Effect - Though not yet discussed in the nonprofit field, I have noted the dynamics resonant of the Bystander Effect both within and between nonprofit boards and senior management. The Bystander Effect was identified as a social-psychological phenomenon in the late 1960s following a very public murder in New York City where it was discovered that nobody on the block called the police, despite screams and commotion on the street. The theory posits that when there are large, proximate groups of people aware of each other’s presence, there is a tendency among individuals to assume behaviors or actions on others where none is being taken. In the NYC case, everyone on the block thought someone had called 911, when in fact nobody had.

I’ve observed, in particular among larger, more “mature” boards where there is evidence of some leadership, that an assumption can arise among the rank and file that the Executive Committee, or President, or some other director is paying attention and attending to things, when they may or may not be. Likewise, I’ve seen senior leadership assume the board will swoop in to the rescue, whilst the board is assuming that management has the ball, only to discover that no one has the ball. At the end of the day, this is still bad management and governance, but it may be why it took so long to pull the red lever. It is telling that one of the UArts board members went on the record with the press saying that she wasn’t even aware there was trouble. Really?

Institutional Munchausen-by-Proxy - Becoming both the savior and executioner of an institution is an effective way to consolidate power, in particular if all is not well and the people in power are at risk of falling from grace. Officially, this syndrome is a psychopathology in the parent-child relationship in which the parent deliberately harms the child so that the parent can then play the role of rescuer/caregiver, while asserting ever-greater control over the child. I’ve seen nonprofit executives (usually founders) and even boards engage in this behavior to maintain control and their institutional interests over those of public good. They deliberately hobble the organization so that they can play the heroic White Knight. This was true of the last president of the Art Alliance and a reason the Alliance went belly up and landed with UArts. It’s not clear to what degree this was at play with UArts, but the apparent disconnect between board and management and secrecy and unclarity around Yager as fundraiser offers a whiff of possibility.

Permanent Failure - Lastly, there is the phenomenon of “permanent failure”, a kind of zombie-like phenomenon that allows companies and organizations to carry on long past the time when they should have failed. Wharton professors Marshall Meyer and Lynne Zucker coined this term in 1989 in their monograph, Permanently Failing Organizations, which examined how both for-profit and nonprofits can endure long past their sell-by dates. Basically, classical theories of the firm say that in a healthy organization, the board and management should be in lock-step alignment on strategy, mission, and impact. But, when adverse events happen that threaten the firm, board and management can have a tendency to fracture and start pursuing separate but parallel self-preservation strategies–the board in its role as fiduciary (not wanting to be held liable or suffer social embarrassment), and management in its role as financially interested wage earner. This can create an organization divided, broken, but hellbent on keeping the shop open to satisfy respective interests, irrespective of whether the mission is being met. When this happens, voilà, you’re in a state of permanent failure.

I’ve certainly witnessed plenty of nonprofits in this condition. Some degree of permanent failure seems to have been operative to have carried UArts as far as they got before permanent failure became absolute failure. Meyer and Zucker point to the assumption of debt to plug structural deficits (instead of solving the underlying problem) as evidence of having arrived at this state. UArts’ audited balance sheet for 2023 shows the addition of a shiny new $2 million line of credit.

Epilogue: Is there a future? Only if philanthropy permits.

So what’s to become of UArts? That’s the multi-million dollar question. In many ways the sins of management and the board are spilled milk under the bridge at this point. UArts is in possession of exceptionally prime real estate in Center City as well as tons of tangible assets and some endowment assets, not to mention an educational and human legacy in its alumni, faculty, and staff. While UArts certainly has an obligation to its creditors, it would be a public trust tragedy for all of that real estate to be sold off to private interest. Once those assets have left the commons of the nonprofit sector, we’re unlikely ever to get them back: public interest loses to private interest, an all-too-familiar tale. Assuming there are any assets left after creditors are paid, the results of their sale would have to go into a conversion foundation (a foundation to hold the proceeds from the sale of public assets to private owners) or other designee of the Attorney General.

The greatest hope we have would be a merger with another education nonprofit where UArts’ resources could remain in service of public good. Just such a merger is (was?) being explored with Temple University in the wake of the announcement. In this connection, Philadelphia’s philanthropic community should not remain blameless. It is true that Philadelphia is one of the poorest cities in the country not just socioeconomically, but also in philanthropy per capita, and philanthropy is finite. Regardless of this fact, I have long observed a pronounced lack of leadership in Philly’s philanthropic community. Our community foundation, the Philadelphia Foundation, lags most of its national peers in investment and innovation, and the handful of other institutional funders seem to do their own thing; collaboration is scarce. There is also a lack of coordination and connection, brokered by institutional philanthropy, to individual private wealth in the region, such as I’ve seen in Houston, Denver, and Seattle. And Philly’s Main Line wealth cleaves tightly to a small collection of legacy nonprofits, rarely supporting the lower nonprofit classes. When it comes to philanthropy, Philly deserves its provincial reputation.

For whatever reason, UArts never achieved first-class nonprofit status among Philadelphia’s bourgeois set, setting it on a troubled course. If Yager failed to raise money, it was not entirely his shortcoming. If you are not among a certain set of institutions and social circles in Philly, fundraising remains an exercise in self-flagellation. UArts’ only major donor of that ilk, the late Mrs. Samuel M.V. “Dodo” Hamilton, heiress to the Campbell's Soup canning empire, was perhaps UArts’ only stalwart patron at the eight-figure level. Her estate’s last gift to UArts, following her death in 2017, has been at issue in the allegations around donation double counting. Apocryphal stories abound about how she would write the university year-end checks to balance the books on many occasions, possible evidence that UArts’ razor-thin margins are nothing new. They were simply pushed to breaking by the economics of the field and stress of the pandemic.

It is thus poetic irony that the Hamilton Family Trust, in a feat of astoundingly snobbish miscarriage of fiduciary judgment, helped to snatch defeat from the jaws of victory by blocking the transfer of UArts endowments (much of them Hamilton money) to Temple. It’s not as though there were other suitors calling with cards. The Trust maintained that Dodo wouldn’t have wanted her assets going to Temple, which I should note is a public university. (Ahem.) Apparently, they failed to see that in preserving UArts’ assets under the stewardship of Temple they would also be preserving her legacy. The long arm of donor control and self-interest exerts its chilly grasp even beyond the grave.

While I was reviewing this to send, the Inquirer broke the news that UArts has declared Chapter 7 bankruptcy and will sell its assets. So in the end, the institution of education that Dodo helped to build seems to be heading to fire sale and will most likely vanish into the mists of time (and the pockets of real estate developers), leaving just the memories of its many students, faculty, and staff to remain.

Such is the folly of philanthropy.

Thank you for this well-thought-out analysis. It’s a welcome relief from the useless speculation.

This is an incredible read. Thank you for taking the time to delve into both the financial reality and the ill-built system that led to the demise of this beloved yet broken institution. As a ‘99 alum, I so appreciate the time and insight you provided in this piece. I hope it gets picked up for broader release as it explains the myriad of cracks in UArts underpinnings that led to the collapse. I wish it weren’t so, indeed fond memories will be all that’s left in the end. And the indelible mark of a UArts education in so many that make and create.